Why Use Google Sheets for Budgeting?

Google Sheets offers numerous advantages for personal budgeting. It’s free, easily accessible from any device with internet access, and provides real-time collaboration features. Additionally, Google Sheets offers various templates to get you started, or you can create a customized budgeting spreadsheet from scratch. With its powerful functions and user-friendly interface, Google Sheets is an ideal platform for managing your personal budget.

Cost-Effectiveness

One of the main reasons to use Google Sheets for budgeting is its cost-effectiveness. Unlike many other financial management tools that require subscriptions or one-time payments, Google Sheets is entirely free. This makes it accessible to anyone with a Google account, eliminating the financial barrier to effective budgeting.

Accessibility and Collaboration

Google Sheets excels in accessibility, allowing you to access your budget from any device with internet access. Whether you’re at home on your computer or out with your smartphone, your budget is just a few clicks away. Moreover, its collaboration feature means you can share your budget with family members or financial advisors, enabling real-time updates and feedback.

Customization and Flexibility

Google Sheets offers unparalleled customization options. You can design your budget template from scratch, tailoring it to fit your specific financial situation. From color-coded categories to personalized formulas, Google Sheets allows you to create a budgeting tool that is as simple or as detailed as you need.

Getting Started with Google Sheets

To begin creating your personal budget template in Google Sheets, you first need to have a Google account. If you don’t have one yet, it’s easy to set up on the Google homepage. Once you have your account, follow these steps:

Setting Up Your Google Account

If you’re new to Google, setting up an account is your first step. Visit the Google homepage and click on “Create account.” Fill in the necessary information such as your name, desired email address, and password. Once completed, you’ll have access to all of Google’s services, including Google Sheets.

Navigating to Google Sheets

Once your Google account is set up, head over to Google Sheets by visiting https://sheets.google.com. Log in with your new or existing Google account credentials. You’ll be greeted with the Google Sheets homepage, where you can view any existing spreadsheets or start a new one.

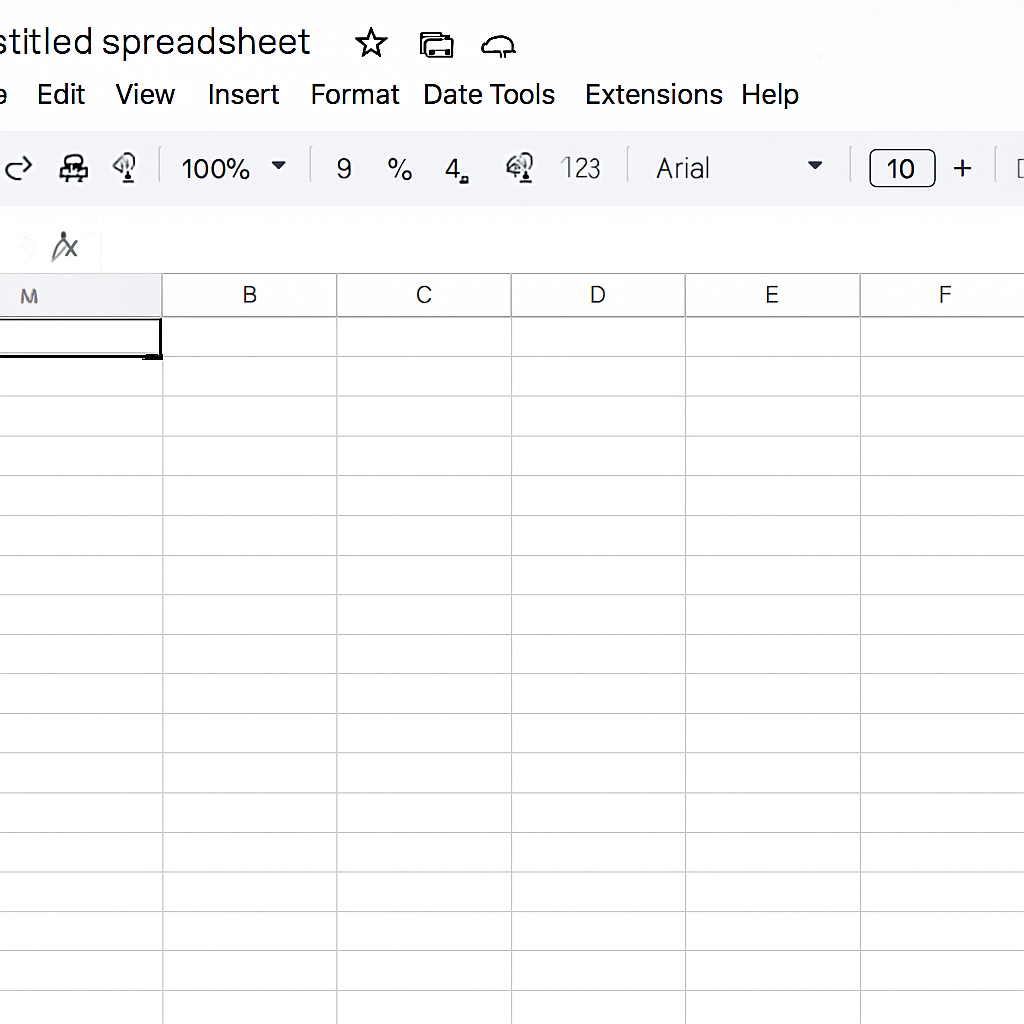

Creating a New Spreadsheet

Starting a new spreadsheet is simple. On the Google Sheets homepage, click on the “+” icon in the bottom-right corner. This opens a new, blank spreadsheet where you can begin building your personal budget template from scratch. Alternatively, you can explore the template gallery for pre-made options.

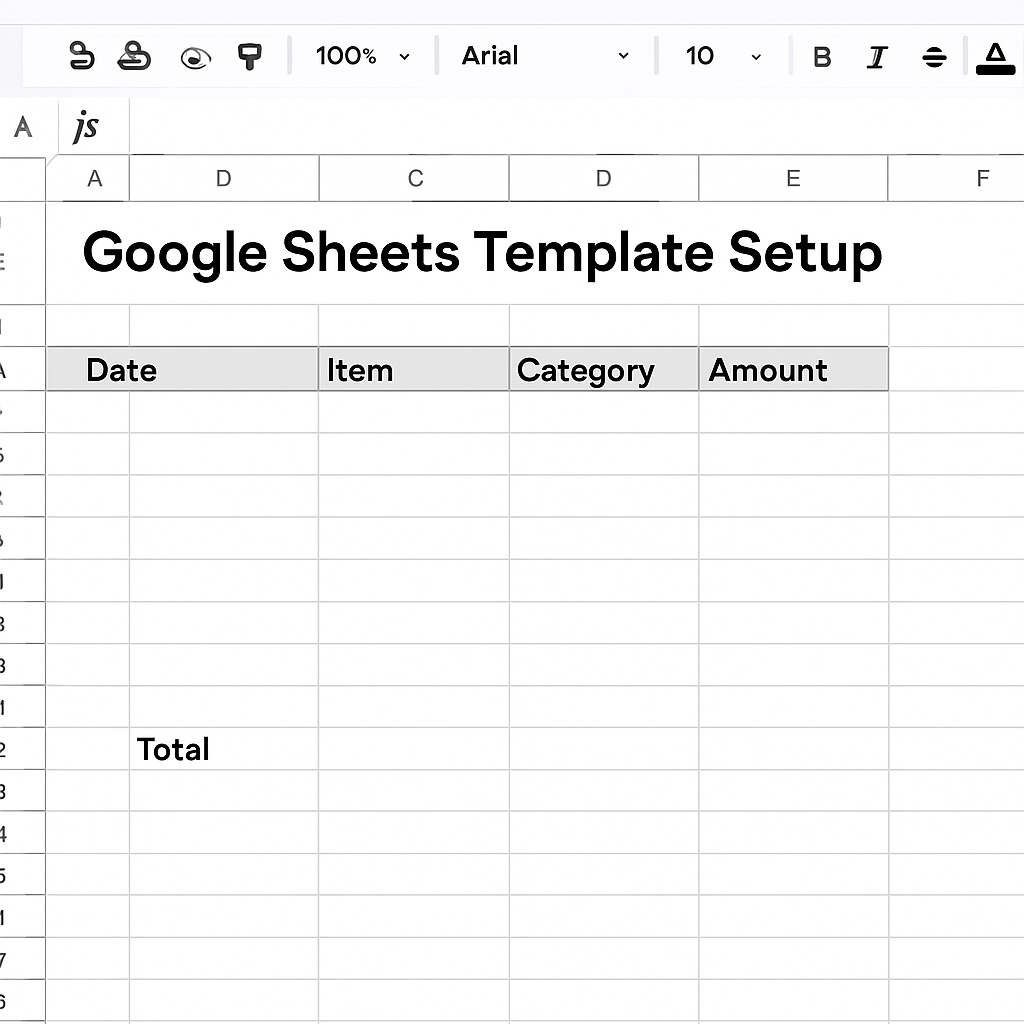

Setting Up Your Personal Budget Template

Now that you have a blank spreadsheet open, you can begin setting up your personal budget template. Follow these steps to create a comprehensive budgeting spreadsheet:

Step 1: Define Your Income Sources

Start by listing all your income sources. These could include your salary, freelance work, rental income, or any other regular income. In your spreadsheet, create a table with columns for the income source, expected amount, and actual amount. This will help you track any discrepancies between your expected and actual income.

Identifying Consistent Income

To effectively manage your budget, begin with identifying consistent income sources. These are streams of money you can rely on regularly, such as your salary or fixed freelance contracts. Knowing these will help in setting realistic financial goals and managing expenses.

Considering Variable Income

Variable income includes earnings that fluctuate, such as bonuses, overtime pay, or irregular freelance work. It’s crucial to account for these in your budget to avoid underestimating your total income. You can create a separate section in your budget for these, estimating conservatively to prevent financial shortfalls.

Tracking and Adjusting Income Entries

Once your income sources are listed, regularly update the actual amounts received. This helps in identifying any changes or trends in your earnings. Periodic reviews allow you to adjust your budget to reflect real-time financial situations, ensuring accuracy and reliability.

Step 2: List Your Expenses

Next, list all your monthly expenses. Categories might include housing, utilities, groceries, transportation, insurance, entertainment, and savings. Under each category, list specific items and their expected costs. For instance, under transportation, you might include gas, public transport, and car maintenance.

Categorizing Fixed Expenses

Begin with listing your fixed expenses, which are regular and predictable. These include rent/mortgage, insurance premiums, and utility bills. Accurately listing these will help you understand the base cost of living and manage your essential financial commitments.

Identifying Variable Expenses

Variable expenses fluctuate monthly and include groceries, entertainment, and dining out. Track these carefully, as they offer opportunities for savings. By identifying patterns in variable spending, you can find areas to cut back and improve your overall budget efficiency.

Allocating for Unexpected Expenses

Set aside a portion of your budget for unexpected expenses. These could be emergency medical bills or urgent car repairs. Having a reserved fund will prevent financial stress and help you manage unforeseen costs without impacting your regular budget.

Step 3: Create a Summary Section

To provide a quick overview of your budget, create a summary section at the top of your spreadsheet. This section should include total income, total expenses, and the difference between the two. This will help you quickly assess your financial standing.

Designing a Financial Snapshot

Your summary section acts as a financial snapshot, offering instant insights into your economic health. Use bold fonts or colors to highlight key figures such as total savings or excess spending. This visual emphasis aids in quick assessments and decision-making.

Monitoring Cash Flow

A well-designed summary section helps track cash flow, showing whether you’re living within your means. Regularly updating this section allows you to see if adjustments are needed to balance income and expenses, ensuring financial stability.

Analyzing Financial Trends

Over time, your summary section will reveal trends in your financial behavior. By comparing monthly data, you can identify spending patterns or income variations, enabling informed financial decisions and long-term planning.

Step 4: Set Up Formulas

Google Sheets allows you to use formulas to automatically calculate totals and differences, saving you time and reducing errors. Use the SUM function to add up your income and expenses, and the = operator to calculate the difference between your total income and total expenses.

Utilizing Basic Arithmetic Formulas

Begin with basic arithmetic formulas to calculate totals. For example, use SUM to add up all income entries or expenses within a category. This basic setup forms the foundation of an automated budgeting system, reducing manual errors and ensuring accuracy.

Implementing Conditional Logic

Advanced users can implement conditional logic using IF statements to flag issues like overspending. By setting conditions, you can automate alerts for when expenses exceed income, helping maintain financial discipline and prompt corrective actions.

Automating Data Updates

Leverage Google Sheets’ functions to automate data updates. For instance, use dynamic cell references to ensure your summary reflects the most current data. Automation reduces manual input needs, keeping your budget accurate and up-to-date with minimal effort.

Step 5: Customize Your Template

Personalize your budgeting spreadsheet by adding colors, borders, and fonts to make it visually appealing and easy to read. You can also add graphs or charts to provide a visual representation of your budget, helping you quickly identify patterns or areas needing attention.

Applying Visual Enhancements

Visual enhancements like color-coding make your spreadsheet more intuitive. Use colors to differentiate between income and expense categories or highlight critical figures. These visual cues facilitate quick comprehension and make financial management less daunting.

Creating Interactive Charts

Incorporate interactive charts to visualize financial data, such as pie charts for expense breakdowns or line graphs for income trends. Visual representations can simplify complex data, offering clear insights into financial health and areas requiring attention.

Tailoring Layouts for Usability

Customize your layout to match your personal preferences, ensuring ease of use. Arrange data logically, using sections or tabs for different financial aspects. A well-organized layout enhances navigation, making your budget more user-friendly and efficient.

by My Profit Tutor (https://unsplash.com/@myprofittutor)

Tips for Effective Budgeting

Creating a budget is just the first step; sticking to it is where the challenge lies. Here are some tips to help you maintain an effective budget:

1. Regular Updates

Ensure that you update your budget regularly. Input your income and expenses as they occur to maintain an accurate picture of your financial situation. Regular updates will help you stay on track and make necessary adjustments promptly.

Frequency of Updates

Decide on an update frequency that suits your lifestyle—daily, weekly, or monthly. Regular updates ensure your budget reflects your current financial situation, aiding in timely decision-making and preventing discrepancies.

Keeping Accurate Records

Maintain detailed records of all transactions. Accurate entries help in analyzing spending habits and identifying unnecessary expenses. This practice promotes transparency and accountability in managing your finances.

Using Automation for Efficiency

Consider using Google Sheets’ automation features to streamline updates. Set formulas to auto-update totals or link transactions from other sheets. Automation minimizes manual work, keeping your budget precise and efficient.

2. Review and Adjust

At the end of each month, review your budget to see how well you adhered to it. Compare your expected and actual income and expenses, and adjust your budget as needed. If you consistently overspend in certain categories, consider cutting back or reallocating funds.

Conducting Monthly Reviews

Set aside time each month for a comprehensive budget review. Analyze deviations between expected and actual figures, understanding the reasons behind them. This routine helps identify spending triggers and improves future budgeting.

Making Necessary Adjustments

Based on your review, make necessary adjustments to your budget. Reallocate funds from overfunded categories to underfunded ones, ensuring a balanced financial plan. Regular adjustments keep your budget relevant and aligned with your goals.

Learning from Financial Patterns

Use your monthly reviews to learn from financial patterns. Recognize consistent overspending areas and explore strategies to mitigate them. Understanding these patterns aids in developing better financial habits and decision-making.

3. Set Financial Goals

Setting financial goals gives you something to work towards and helps you prioritize your spending. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, having clear goals can motivate you to stick to your budget.

Defining Short-Term Goals

Start with defining short-term goals that can be achieved within a year. These could be building a small emergency fund or paying off a minor debt. Short-term goals provide quick wins, boosting motivation and discipline.

Establishing Long-Term Objectives

Long-term goals require more planning and discipline, such as saving for retirement or buying a home. Clearly define these objectives, outlining the steps and timeline needed. Long-term planning ensures sustained financial growth and security.

Tracking Progress and Adjusting Goals

Regularly track your progress towards financial goals. Adjust goals as needed based on changes in your financial situation or priorities. Flexibility in goal-setting ensures they remain realistic and achievable, enhancing motivation and commitment.

4. Use Google Sheets Features

Take advantage of Google Sheets’ features to make budgeting easier. Use conditional formatting to highlight overspending, or set up data validation to restrict input to certain categories. Explore the wide range of functions available to automate calculations and enhance your budgeting process.

Leveraging Conditional Formatting

Use conditional formatting to visually alert you to overspending. Set rules to change cell colors when expenses exceed budget limits. This feature provides immediate visual feedback, prompting timely financial adjustments.

Implementing Data Validation

Data validation restricts inputs to predefined categories, ensuring consistency and accuracy. By limiting input options, you reduce errors and maintain a structured budget. This feature simplifies data entry, improving overall efficiency.

Exploring Advanced Functions

Explore advanced Google Sheets functions like QUERY or ARRAYFORMULA to enhance your budget. These functions allow complex data manipulations, offering deeper insights into financial trends. Advanced features elevate your budgeting skills and accuracy.

Conclusion

Creating a personal budget template in Google Sheets is a straightforward and effective way to manage your finances. With its accessibility, ease of use, and powerful features, Google Sheets provides a perfect platform for budgeting. By following the steps outlined in this guide and implementing effective budgeting practices, you can take control of your financial future.

Remember, the key to successful budgeting is consistency and adaptability. Regularly updating and reviewing your budget will help you stay on track and achieve your financial goals. With your personal budget template in Google Sheets, you’re well-equipped to manage your finances and make informed financial decisions.

Take charge of your financial well-being today by leveraging the power of Google Sheets. Whether you’re budgeting for a major life event or simply aiming to improve your financial health, this tool offers the flexibility and functionality to meet your needs. Embrace the simplicity and effectiveness of digital budgeting and pave the way for a financially secure future.